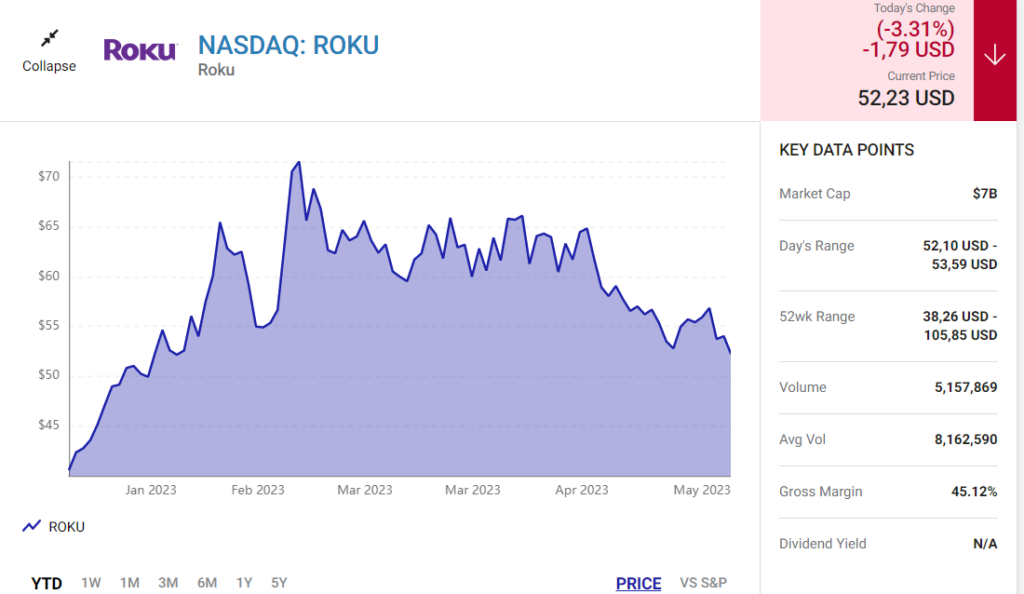

While the immediate outlook may appear bleak for this popular streaming service, it possesses significant potential for long-term growth. Roku (ROKU -3.31%) recently released its quarterly results for the first quarter of 2023.

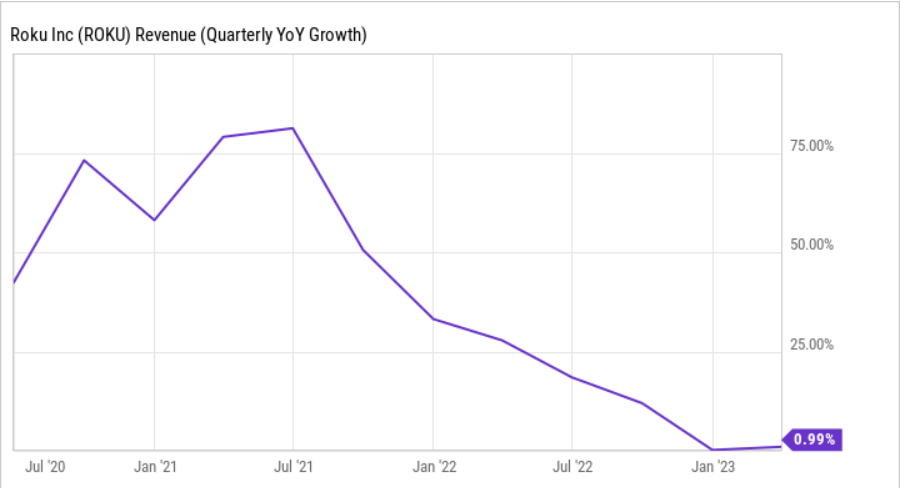

Unfortunately, investors were disappointed with its projected revenue growth of only 1% year-over-year for the second quarter, following a similar growth rate in the first quarter. This lackluster revenue growth suggests that a recovery may not be on the horizon, leaving many investors feeling indifferent towards the company.

As a result, the stock price currently languishes at 88% below its all-time high of $480 on July 21, 2021. However, there remains hope for bullish investors.

Despite the prevailing negativity surrounding the company, Roku’s long-term fundamentals continue to be attractive. Let’s delve into the reasons why long-term investors may want to consider adding this stock to their list of potential purchases.

Uncertain short-term future?

Roku’s revenue generation primarily relies on service fees charged to content publishers and advertising services provided to both publishers and advertisers. This business model thrives in a growing economy but suffers in times of economic slowdown.

The company encountered significant challenges in 2022 when the Federal Reserve swiftly raised interest rates to combat inflation, leading to a decline in consumer demand.

With the fear of a recession looming, advertisers substantially reduced their advertising expenditures, particularly in the ad scatter market, which involves the purchase of unsold ad inventory shortly before a show airs.

Unfortunately for Roku, its advertising business heavily relies on the ad scatter market, resulting in a sharp decline in revenue growth.

The resumption of growth in the ad scatter market is likely necessary for Roku to experience a revival in revenue growth.

Additionally, despite Roku’s existence since 2002 and its status as a public company since 2017, it remains relatively early-stage. The company only recently achieved significant profitability in 2021, largely due to a surge during the pandemic.

The stock is attractive over the long term on Roku

In response to the market downturn, Roku’s management has adopted a revised approach, moving away from a growth-at-all-costs mindset and implementing a more cost-efficient strategy. They are now focused on eliminating projects or activities with low returns on investment while prioritizing investments in essential streaming platform infrastructure for consumers, content publishers, and advertisers. Additionally, the company is actively seeking to introduce new profitable revenue streams.

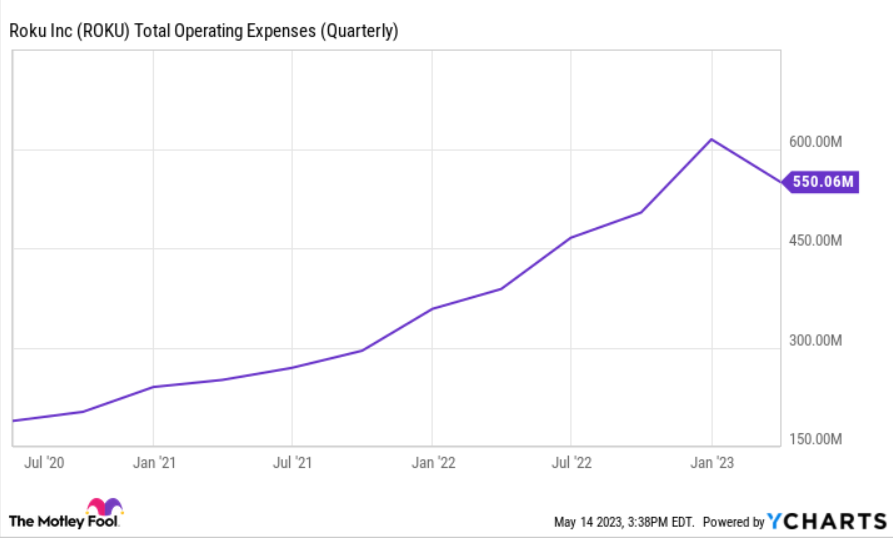

One positive outcome of this new strategy can be observed in the chart below, where the relentless increase in operating expenses since 2020 has been halted. Roku’s quarterly operating expenses decreased from $614 million in the fourth quarter of 2022 to $550 million in the first quarter of this year.