As of July 26, 2021, Roku’s (ROKU 2.46%) stock reached an all-time high of $479.50, largely driven by its impressive growth rates and the surge in demand for streaming devices and software during the pandemic.

The company experienced remarkable revenue growth of 58% in 2020 and 55% in 2021, fueled by the increased consumption of streaming video as people stayed at home.

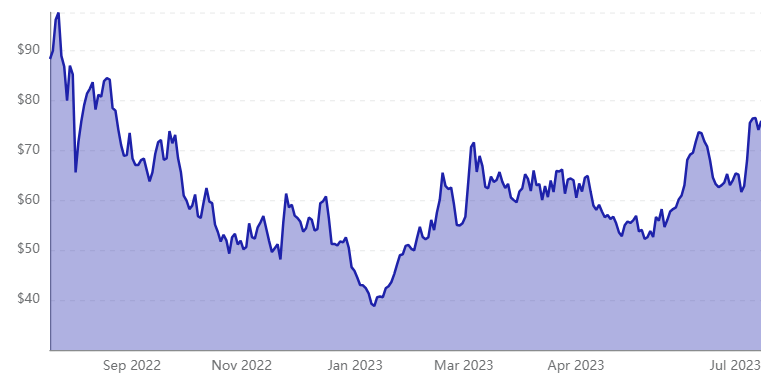

However, in 2022, Roku’s revenue growth slowed significantly to just 13% at $3.1 billion. This deceleration was primarily due to the waning tailwinds of the pandemic and the emergence of inflation’s headwinds.

Consumers purchased fewer streaming devices, leading to supply chain disruptions and losses on each device sold. Additionally, companies reduced their ad spending on Roku OS, impacting its advertising revenue.

Increasing the Investments

Moreover, Roku increased its investments in original content for its Roku Channel and the production of first-party smart TVs.

As a result, its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) turned negative, reporting a loss of $84 million in 2022, a stark contrast to the $465 million profit in 2021.

These challenges prompted many investors to sell their shares, causing Roku’s stock price to drop to $74.

Despite the recent setbacks, there are three positive indicators suggesting potential brighter days ahead for Roku.

However, the company will need to address the factors that hindered its growth in 2022 and find a balance between content investments and profitability to regain investor confidence and drive future success.

The 3 Green Flags

Expanding Audience

Base Although Roku’s growth rate has decelerated, the company continues to attract new viewers. In the first quarter of 2023, the number of active accounts surged by 17% year over year, reaching 71.6 million.

Additionally, total streaming hours experienced a 20% rise, reaching 25.1 billion. The Roku Channel, offering free ad-supported streaming video services, also enjoyed a 25% increase in viewers, boasting about 100 million viewers by the end of 2022.

This significant audience expansion places Roku in a strong position amidst fierce competition from Amazon, Apple, and Google’s Alphabet, all vying to attract viewers to their subscription-based streaming video services. Thus, it is premature for pessimists to predict Roku’s obsolescence.

Expansion into Google’s Ecosystem

Roku future predominantly generates revenue and gross profits from its software platform. Consequently, the company’s focus lies in extending the reach of Roku OS and Roku Channel to a wide array of third-party devices, rather than merely increasing the sales of its own first-party streaming devices.

This strategic approach allows Roku to establish a stronger presence in the market and capitalize on the growing demand for its software platform. By strategically expanding into Google’s ecosystem, Roku can further solidify its position in the highly competitive streaming industry.

Partnership with Shopify

Both Roku and e-commerce services company Shopify faced challenges during the post-pandemic slowdown. However, their new partnership promises potential synergies and unexpected tailwinds.

Under this collaboration, Shopify can post shoppable ads across Roku’s platform. Roku’s users gain the convenience of clicking on the ads to explore products, complete purchases directly through their TVs using Roku Pay, and seamlessly return to streaming video content. This approach streamlines the advertising funnel, shortening the path from brand awareness to purchase on the largest screen in homes.

While the immediate impact of these shoppable streaming ads remains uncertain, this partnership has the potential to diversify and strengthen Roku’s higher-margin advertising business in the long run. It opens up new avenues for generating revenue and offers an innovative way for brands to connect with their target audience.

Positive Indicators for Roku Future

However, these positive indicators don’t completely address Roku’s immediate challenges. While the stock appears reasonably priced at less than 4 times this year’s sales, it might be wiser to invest in a more straightforward streaming play like Netflix rather than waiting for Roku’s multifaceted mix of hardware, software, and ads to regain momentum.

Before making any investment decisions regarding Roku, it’s essential to consider other factors. The Motley Fool Stock Advisor analyst team recently disclosed what they believe are the top 10 best stocks for investors to buy at this moment, and Roku did not make the list.

It’s crucial to thoroughly research and analyze the current market conditions and various investment options before making a final decision.

Investors should carefully assess their investment goals, risk tolerance, and overall market outlook to make informed choices aligned with their financial strategies.

It’s always wise to consult with a financial advisor or conduct in-depth research before committing to any investment opportunity.