Buying Roku shares is certainly one of the most interesting investments in this sector.

The growth of this stock has been impressive, but is it the right time to buy?

To answer, we need to evaluate both the trend of the stock market and the company’s revenue and earnings. After reading our guide, you will have all the elements to decide on this investment.

How can we buy Roku shares? Just follow these 3 steps:

- Register with a CFD Broker like eToro

- Slect the Roku stock

- Click Buy to bet on the rise (or Sell to bet on the fall).

This guide will not only provide you with the necessary data to evaluate the investment, but also which Broker is best to use to buy Roku shares safely and in the most intuitive way, even for beginners.

Why invest in Roku

Roku is listed on Nasdaq, but this is not a limitation for those who want to buy Roku shares.

Direct purchase Direct purchase is one of the most common but also more limited investment methods.

The reasons are: economic, because usually people turn to bank brokers who charge rather heavy commissions (especially for less capitalized traders); operational, because the investment is only possible on the rise.

One solution to overcome the first disadvantage is to turn to eToro for the purchase of real stocks. The broker (which we will analyze in more detail later) allows for the direct purchase of shares on its platform, on more advantageous terms than bank brokers.

3 solution Help you to invest in Roku

The best way to choose among these 3 is to access the free Demo accounts offered by these intermediaries. In this way, you can evaluate the features, trading platforms, and services offered before depositing any money.

Once you have chosen, to invest in Roku stocks, you just need to:

Buy the Roku CFD to profit from the increase in the stock price. Sell the Roku CFD to profit from the decrease in the stock price. Once you have reached your goal, you can close the operation and collect the net profits without paying any commissions.

Is buying Roku stock worth it?

2022 was a very positive year for Roku, with the TV streaming platform’s stocks increasing by over 130% during the year, outpacing both Nasdaq and the S&P 500.

The platform saw a strong increase in usage, also due to COVID-19 lockdown measures, and investors were rewarded.

But with this very high valuation (Roku has a price-to-earnings ratio of 25), the company must find new ways to profit from its platform.

Between 2020 and early 2021, Roku had 46 million active accounts, up 43% from the previous year, and 14.8 billion streaming hours on its platform, with a 54% increase.

These high double-digit growth rates show how quickly the company is becoming essential in the streaming platform landscape.

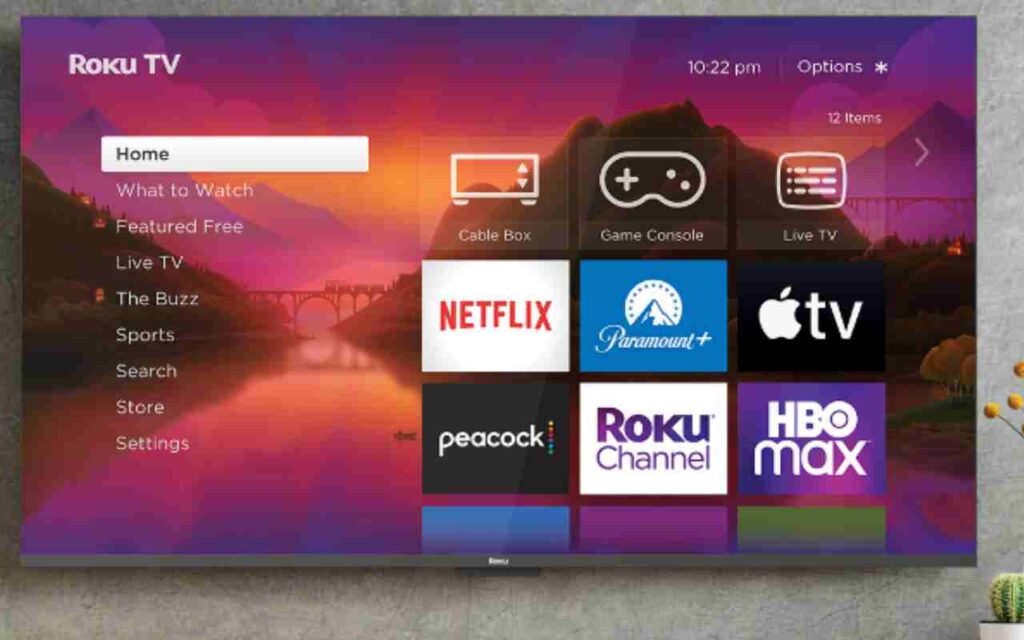

Currently, Roku holds about 49% of the streaming device market, beating Chromecast, Amazon Fire TV, and Apple TV.