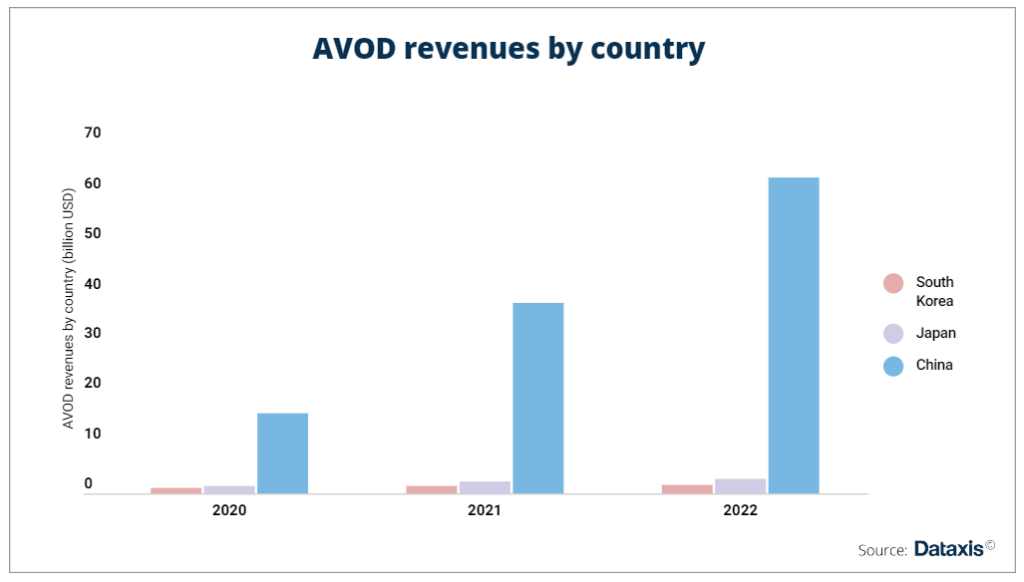

In the three major markets of East Asia, AVOD has recorded strong growth in recent years. This is possible thanks to new levels supported by advertising from global streaming players. It could be argued that this demonstrates consumer fatigue for paid content.

Furthermore, this trend may also stem from a traditionally strong consumption of traditional TV that is returning. At first glance, the overall increase in AVOD revenue seems to show that consumers increasingly prefer to watch advertisements to avoid subscription fees. The market that is growing the most is in China.

Number of AVOD

In South Korea, growth has been more moderate, with revenues generated by AVOD platforms amounting to KRW 1.93 trillion ($1.7 billion) in 2022, compared to KRW 1.32 trillion ($1.1 billion) in 2020. China not only has the fastest-growing market but also by far the largest, even when accounting for the population of the three countries.

At first glance, it seems that China is simply one step ahead of Japan, which in turn is ahead of South Korea.

In reality, the different growth rates correspond to the different states of maturity of the SVOD markets. The Chinese SVOD market is saturated, and most platforms lost subscribers in Q4 2022. The total number of subscribers even decreased from 385 million in Q2 2021 to 375 million in Q2 2022.

Japan and South Korea will not reach this state soon, as both are still experiencing strong growth in SVOD. However, this does not mean that the growth of AVOD is only fueled by subscription fatigue. It is still growing slowly but steadily in China and South Korea, reaching 583 million and 31 million subscribers, respectively.

Only Japan is experiencing a significant contraction, with its subscriber base decreasing from 2021 (now at 18 million people), and revenues and ARPU decreasing from 2020. Similarly, the growth of AVOD cannot be explained solely by viewers’ strong preference for free content, traditionally through FTA TV channels.

Although it has been a uniform trend in the three countries, free television is more widespread in Japan and South Korea, where two-thirds of Japanese families and half of South Korean families still watch it. While it represents only 27% of Chinese families. In South Korea, indirect cable plays the role of broadcasters in the clear, as local operators distribute their channels.

Advertisers are targeting AVOD in all three countries, perhaps although China, Japan, and South Korea are not experiencing similar maturity stages in different segments of the audiovisual content industry. This can be measured by analyzing the share of advertising expenditures (ADEX) spent on the digital industry.

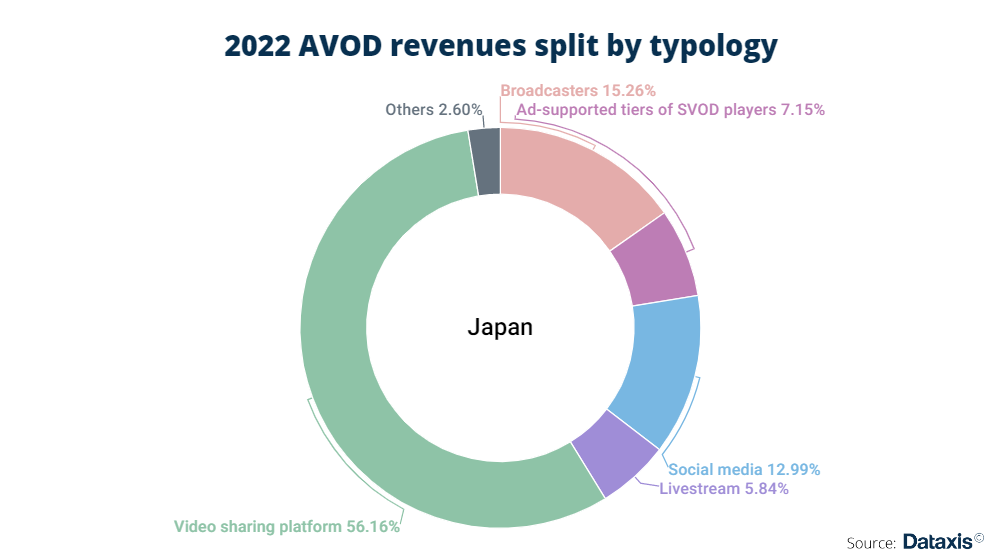

As a results In the ranking of the three countries from least to most digitized, Japan is the first, with only 44% of total ADEX spent online in 2022, compared to 36% in 2020.

Although traditional media still dominate this market. The growth of digital video advertising is dynamic. The total amount spent on ADEX video increased from JPY 386.2 billion (22% of digital ADEX) to JPY 590 billion (24%).

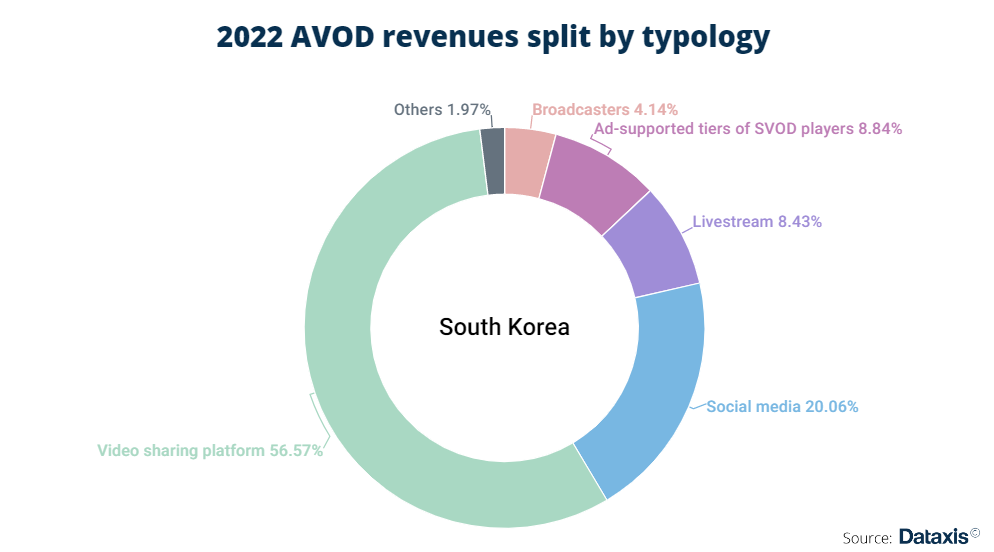

Youtube vs Naver

In contrast, YouTube is only the second most popular service in South Korea. Where local tech company Naver dominates the market with Naver Now (formerly Naver TV). Similarly to Japan, all major broadcasters (SBS, KBS, MBC, YTN, TV Chosun…) have launched their platform and have also partnered with Naver to have an individual gateway on the website’s homepage.

However, since they do not own the platform, the revenue generated on it is shared between them and Naver, which aggregates all their content and is therefore the preferred option for consumers. Furthermore, Naver’s revenue maximization strategy is much less aggressive than that of YouTube and TikTok.

As a result, it ranks only third in terms of revenue, not much ahead of local streaming player Wavve. This situation embodies the dilemma that platforms face when they have to balance monetization with expanding their subscriber base.

Depending on their ownership structure and the market in which they operate, they will opt for different business models to achieve their goals. Since South Koreans have a much lower.