At the end of 2022, addressable TV advertising on HbbTV or set-top boxes had only been launched in 17 European countries. Let’s see how the UK achieved this with AdSmart.

In some of these countries, serious restrictions have been introduced, limiting addressability only to catch-up services.

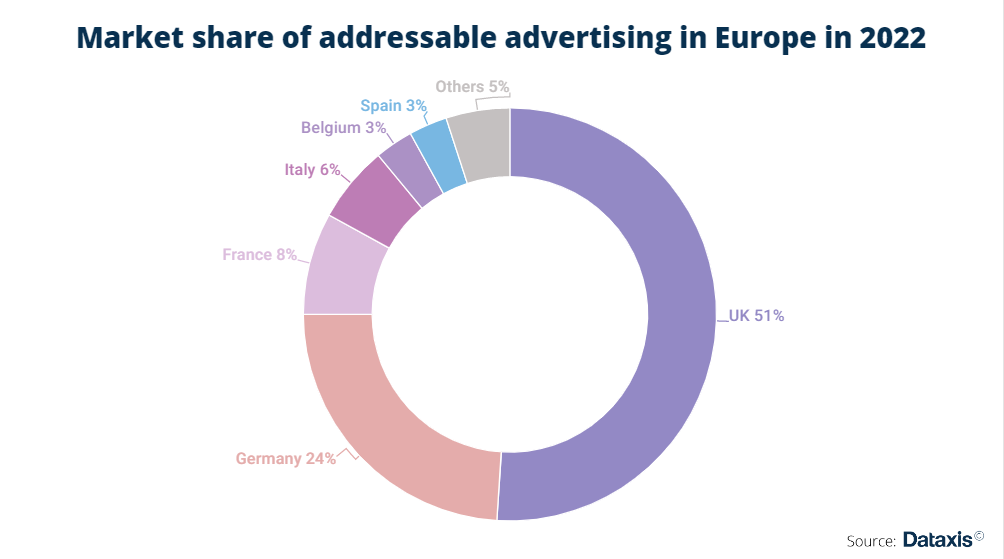

The United Kingdom remains by far the leader of the addressable TV advertising industry: with its well-established solution AdSmart, it secures over half of the sector’s revenue across Europe.

AdSmart has proven to be a continued success. Also despite limited growth in recent years as the product is already mature enough, has paved the way for what addressable TV advertising should be.

It has been presented as the ultimate model for every broadcaster and distributor that has followed afterward. But not everyone has been able to replicate the experience with such a favorable outcome, especially since each TV and advertising market in Europe has its own specificities to consider.

More than a decade after the launch of AdSmart, how is the market doing outside of the UK?

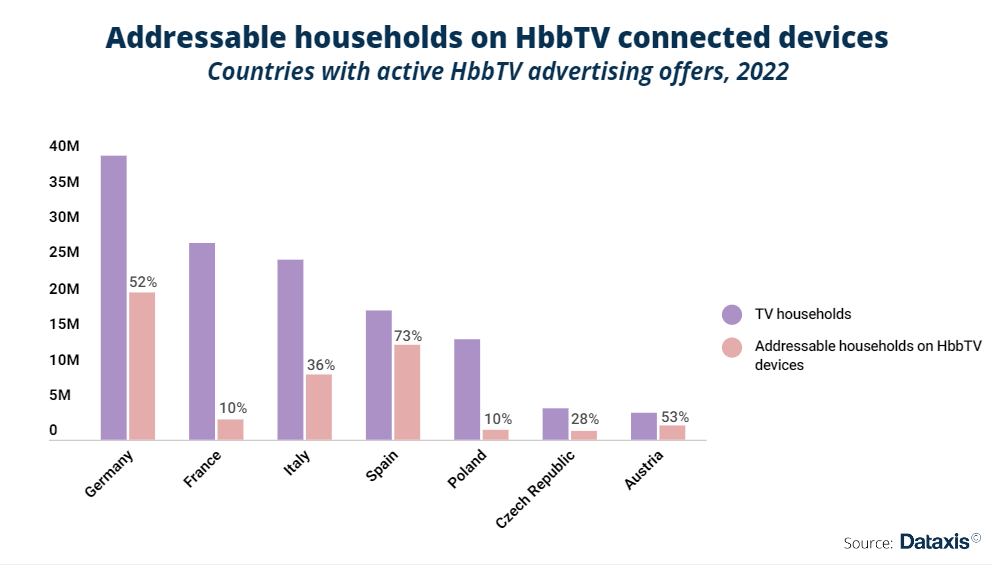

The structure of the TV distribution market in each country defines whether and how addressable TV can be implemented. In Germany, the second largest addressable advertising market in Europe, local supporters have pushed for addressable advertising campaigns to be launched on HbbTV levels very early on.

The two main advertising sales agencies of commercial broadcasters, SevenOne Media and RTL Ad Alliance, launched commercial offerings with addressable capabilities on this technology as early as 2016.

Today, over half of German TV households are equipped with connected HbbTV devices can be target based on advertisers’ audience needs.

With the gradual spread of TVs with the latest HbbTV standards. Targeted campaigns are slowly moving from L-shaped banners to dynamic advertising inserts

Structuring addressabile Tv: at the crossroads between HbbTV and addressable set-top boxes.

If HbbTV emerge as the optimal solution for advertising sales agencies in Germany, Spain, and Italy, it’s a different story in neighboring countries where pay-TV offers and telecom operators dominate the TV distribution landscape.

In Belgium, Proximus and Telenet bring addressable campaigns to almost 3 million households, covering over 70% of the Flemish market and just over half of the French-speaking market. The addressable footprint of both operators combines to reach 60% of the entire country.

In France, it’s still the telecom operators managing the implementation of the addressable ecosystem, and they do so through their set-top box inventory.

IPTV in France reaches 60% of the total number of households. It was therefore obvious that operators should be involved if advertising was ever going to see the light in the country.

And from the outset, all 4 telecom operators met to discuss the potential of the market with local TV producers.

The industry only waited until the summer of 2020 to see authorities adopt a decree legalizing targeting and personalization of TV advertising campaigns.

Since then, every broadcaster and operator agrees to participate, but the entire market is still struggling to scale. Orange and Bouygues cover most households on their combined footprint, but SFR and Free must also be involved to truly expand the market to its full potential.