The television industry, once a universal and pervasive medium in the analog era, is undergoing a profound digital transformation that affects all sectors of the economy and society.

The critical question is whether traditional communication and consumption models can still find a place in the emerging digital ecosystem or if the role of television is destined to diminish.

2025 report

The 17th ITMedia Consulting Report, titled “The TV Market in Italy 2023-2025”. Of Tomorrow, There is No Certainty,” highlights this transition. Suggesting that the future of television can no longer be confined to traditional linear TV but must include the growing phenomenon of video streaming and on-demand services.

By 2025, Broadband TV is expected to reach 13.2 million households, surpassing half of the Italian families with a television. Pay-TV will solidify its lead over free-to-air TV, growing from 59% in 2023 to 61% of total TV households by 2025.

TV market is projected to remain stable over the 2023-2025 period, with an average annual growth rate of 0.5%, more pronounced in 2025.

Advertising is set to grow slightly (+0.9%) thanks to online contributions offsetting declines in broadcast advertising (generalist and thematic channels). Pay-TV is also expected to see a similar increase (+0.9%), having reached maturity, including the paid streaming video component (SVoD).

By 2025, Sky, Mediaset, and Rai will collectively hold 70% of the total TV market, maintaining a dominant position, while other operators will account for 30% of the total.

Sky will continue its decline (-2.6%), albeit at a slower pace than in the recent past, ceding leadership to Rai (27%) and being matched by Mediaset, which remains stable or sees slight growth thanks to investments in online advertising and a hybrid DTT/Broadband model.

Mediaset grow up!

In the advertising sector, Mediaset, with slight growth, will remain the leading operator, capturing 58% of total resources—two percentage points higher than in 2022. In the pay-TV space, Sky will retain its leadership despite further reducing its market share from 50% in 2022 to 43% in 2025, due to the shift of pay services to streaming, dominated by global operators.

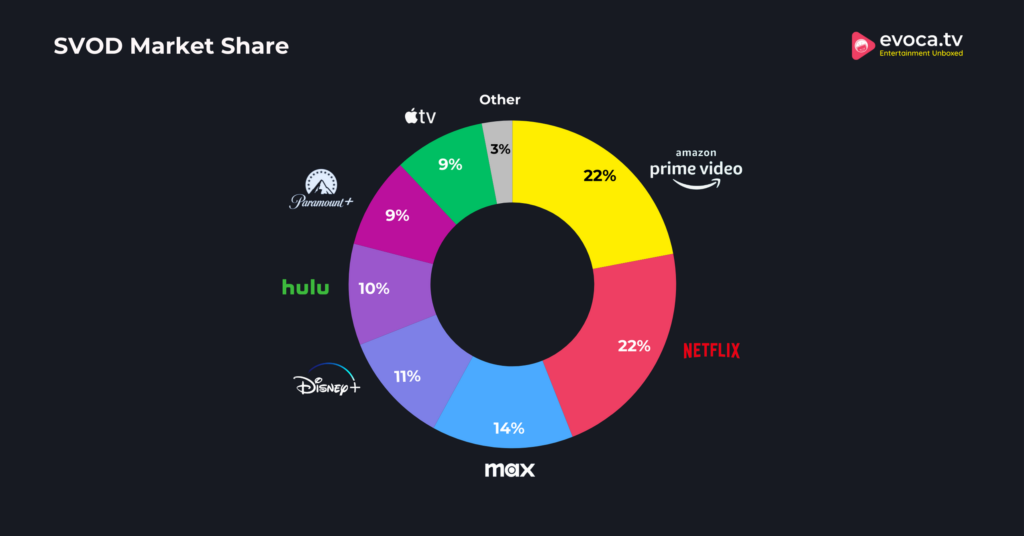

Other operators (Netflix, Disney, Amazon, Discovery, etc.) will no longer grow at double-digit rates as in the past, slowing their expansion (CAGR +4.7%). In this context, a novelty emerges: advertising is growing faster than pay-TV.

Two new trend

Two significant trends are emerging: on one hand, the development of connected TV and online advertising linked to hybrid business models; on the other, the growing presence of video-sharing platforms (such as YouTube and TikTok) in the digital ecosystem, offering personalized content through generative artificial intelligence. Given their target audience, these platforms represent powerful tools for influencer marketing, attracting a significant share of online advertising resources.

In addition, the gaming sector, along with online advertising, has recorded the highest growth rates in the entire entertainment and media industry. Video games increasingly resemble audiovisual content production, even in terms of user perception, who consume them in similar ways.

Amidst these epochal changes, the only certainty emerging from the ITMedia Consulting Report is that the sector is about to enter one of the most delicate and uncertain phases in its history.