Provided in the form of a Box or Stick, allows users to access a wide range of channels in the form of applications.Currently, it is the most widespread system in North American households (45%). Now also available in Europe through Sky in the Box version, or independently, as it is included in Roku Smart TVs.

Roku enables monetization through 3 different business models: SVOD (Subscription Video On Demand), TVOD (Transactional Video On Demand), and AVOD (Advertising Video On Demand), where Roku itself provides ads in the form of pre/middle/post-rolls. Roku will also handle user purchases and revenue payments for you

Roku’s Spread

Originating solely in the USA, it is now widespread in South America, including Brazil, as well as Europe.

Activating a Roku channel now would mean spreading your content not only in North America but also in territories where other types of technology struggle to reach.

In general, creating and launching a Roku channel is a strategic business move that has been shown to increase revenue by 30%.

If the goal is to penetrate the North American market and step foot in Brazil and other South American countries at no additional cost, Roku is by far the best choice, being the most popular among streaming devices.

Currently has over 70 million active accounts. This makes it the largest streaming device provider worldwide.

Why Roku

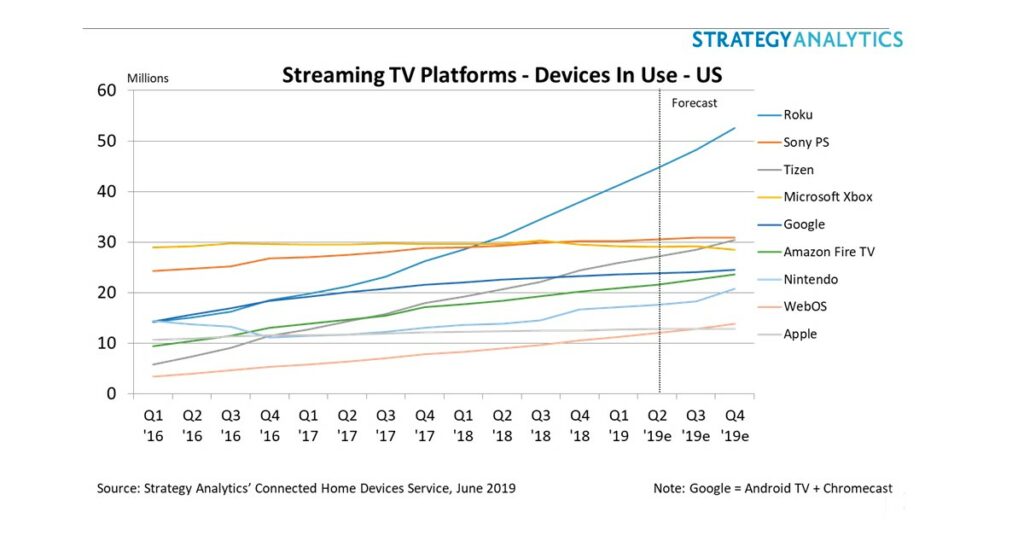

The Roku Box platform represented over 54% of U.S. sales of connected TV devices, surpassing its historical competitors Sony PlayStation and Apple TV. Neither Amazon nor Google, despite aggressive marketing policies, have achieved dominance in streaming.

Roku is also the most purchased device by American families, in stark opposition to Chromecast and Apple TV. In an increasingly competitive market with some of the biggest names in technology vying for position, it’s impressive to see a company like this, Inc. carve out nearly half of the market share with a 54% market share.

Amazon Fire TV has recently emerged as the third leading player with a 16% market share. The only one that seeks and could challenge Roku’s leadership.

Three other specific factors are driving the acceleration of “cord-cutting”:

- an abundance of high-quality content available through streaming

- the value of free AVOD services

- the convenience of streaming Roku announced it surpassed 80 million monthly active users in 2023, growing by 16% year over year. The vast majority (82%) of survey respondents are extremely satisfied with their decision to cut the cord, with 92% of native customers sharing the sentiment.

Half of Roku’s U.S. customers do not have traditional cable and satellite subscriptions and enjoy the value, ease, and breadth of content offered by Roku. The transition to streaming is increasingly popular and growing faster than ever.

Roku’s Expansion

Roku is now in the advanced phase of expansion into international markets.

Expecting the growth rate of video streaming penetration globally to surpass growth in the United States.

Another particular aspect to consider is that Roku’s stocks have held up so well during such a historic moment: amid two wars involving the USA (Ukraine and Israel), along with a poor economic situation.

For the entire year, streaming hours on Roku reached a record 87.4 billion hours, growing by 19%. In the fourth quarter, platform users’ streaming hours reached an all-time high of 23.9 billion hours, also up 23% year over year.

Roku is finally fulfilling its commitment to launch internationally. The company has launched its smart TV in partnership with Hisense and TCL.

The company has beaten the competition in the U.S. market thanks to its technical partners. In the first quarter, one in three smart TVs sold in the United States had the operating system. The simplicity of its interface is to be considered as a tactical advantage.

However, does not have the same advantages in Europe as in the United States and will have to fight hard to reach the competitor Amazon Fire TV.