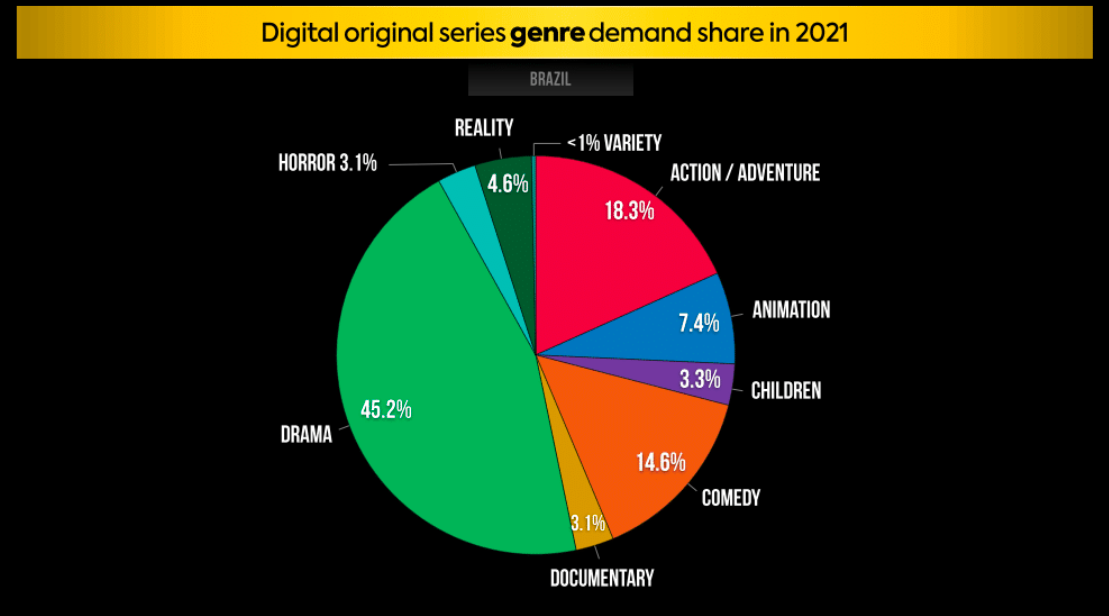

Brazil’s Preferences in Digital Original Genres and Subgenres: In this report, Brazil shares the top spot with Canada as the market with the highest affinity for horror, both allocating a 3.1% demand share to the genre in 2021.

Brazil secures the second-largest demand share for digital original action/adventure series, maintaining an 18.3% share, consistent with the previous year’s allocation.

Svod platform in Brasil

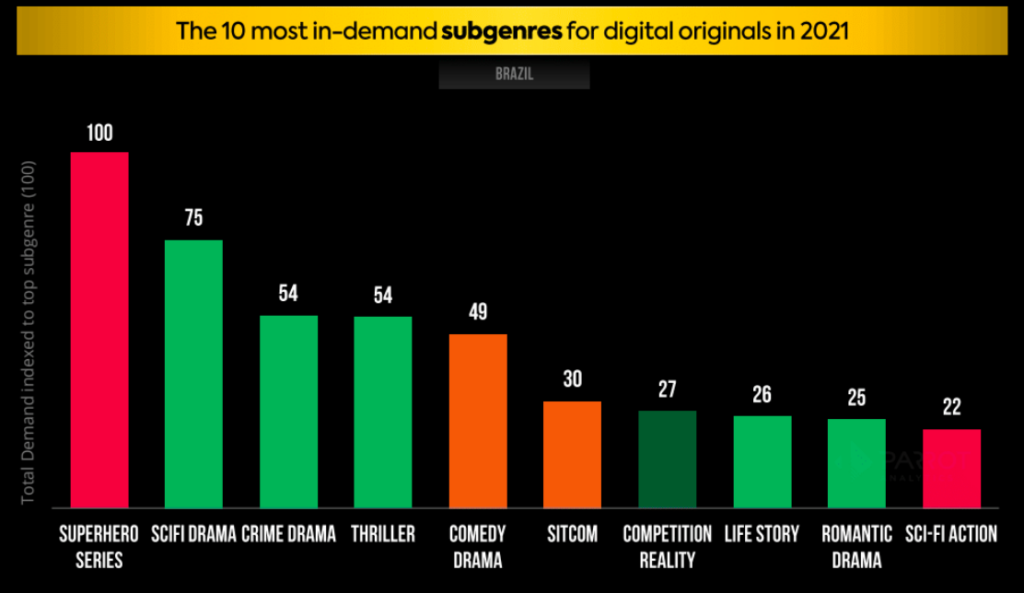

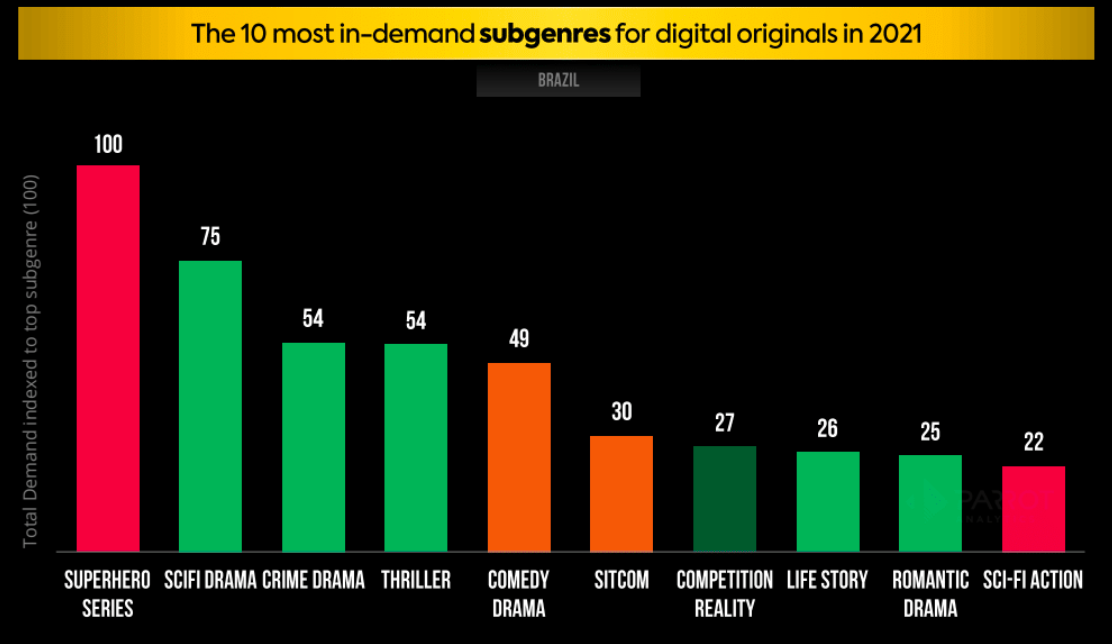

The Brazilian audience‘s demand for this genre increased from 2.8% in 2020 to 4.6% in the current year. Superhero series emerges as the most sought-after digital original subgenre in Brazil, commanding a considerable lead over the second-ranked subgenre, sci-fi drama, which experiences a 25% lower demand than superhero series in 2021.

In a distinctive achievement, the competition reality subgenre proves exceptionally successful in Brazil, ranking as the 7th most in-demand subgenre globally.

Stands out as the only market in this report where a reality subgenre secures a position among the top ten most in-demand.

The life story subgenre claims the 8th spot in demand in Brazil for 2021, achieving its highest rank in this report, similar to its performance in Mexico.

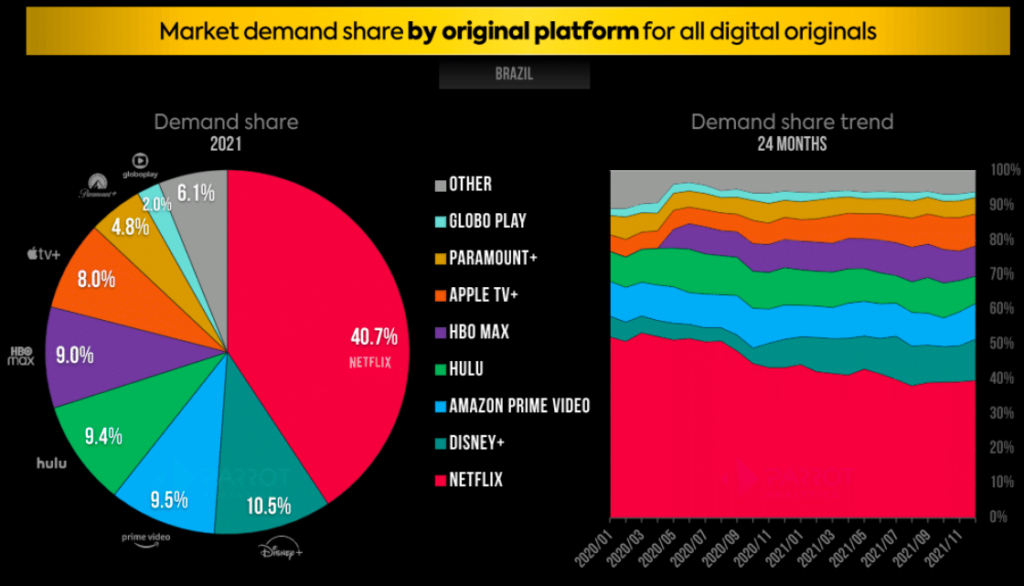

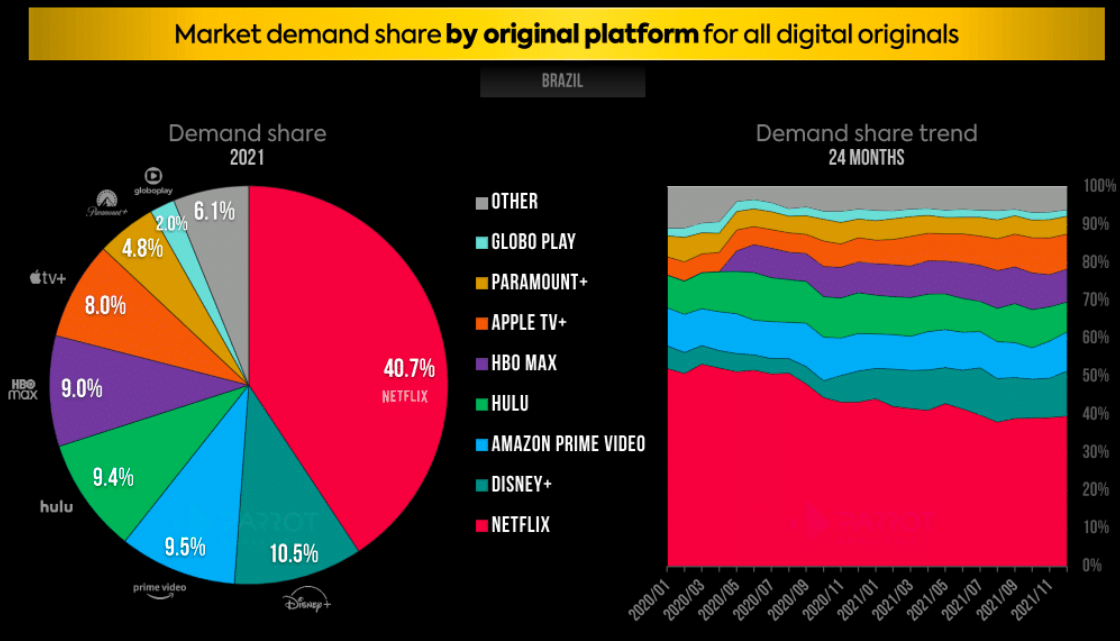

Brazil’s Platform Demand Share and Digital Originals Demand Distribution: Brazilians allocate a larger share of demand to HBO Max originals than any other market in this report, with a 9.0% demand share, surpassing the global share of demand for the platform’s content, which stands at 5.0%.

Hulu initially held the largest share of demand for its originals in Brazil, but by the end of the year, its share contracted to 7.8% in December 2021. Throughout the year, there was a competitive race for demand share among Apple TV+, HBO Max, and Hulu in Brazil.

Started with the lead, HBO Max took over mid-year, and by the end of the year, Apple TV+ claimed the largest demand share of the three platforms.

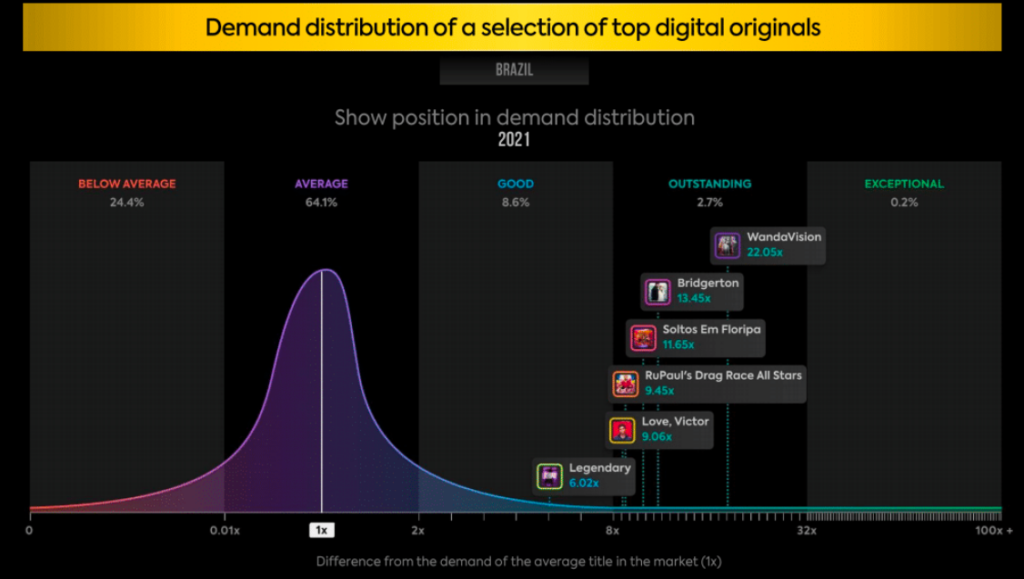

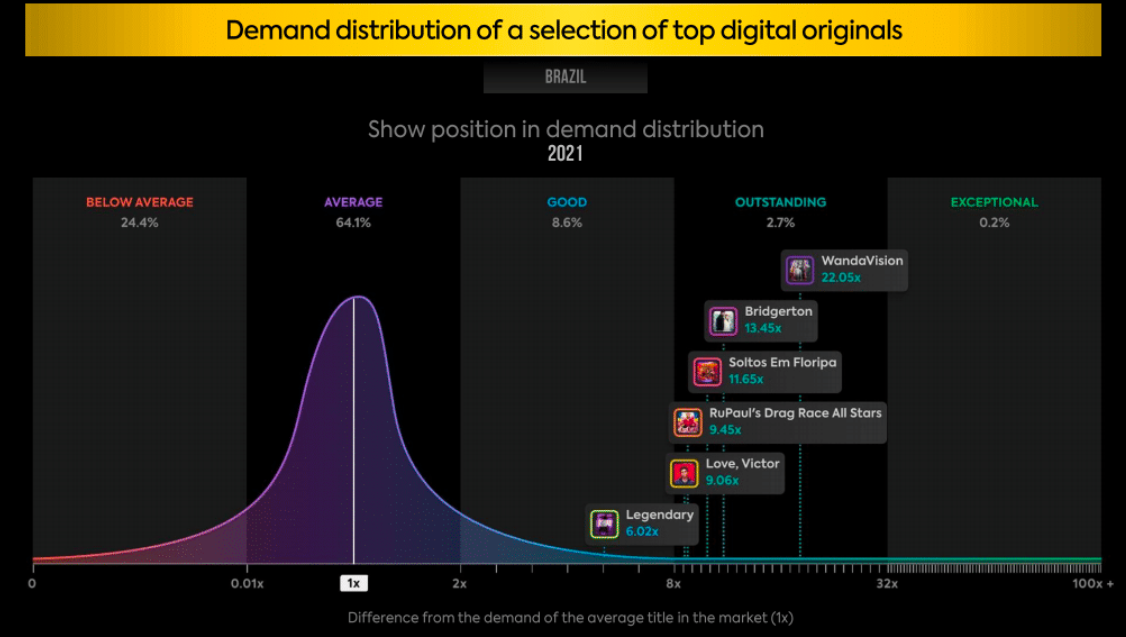

WandaVision emerged as the most in-demand digital original in Brazil for 2021, making Brazil one of the two markets (alongside Mexico) where the series held the top position, boasting 22.05 times the average series demand in the country.

Brazil stands out as a reality-loving market, with high demand for series like Soltos em Floripa, RuPaul’s Drag Race All Stars, and Legendary, which ranked higher in Brazil compared to any other market in this report (13th, 15th, and 48th, respectively).

Bridgerton garnered a particularly strong fan base in Brazil, surpassing its demand in any other market globally with 13.45 times the average series demand.

Brazilians allocate a larger share of demand to originals from HBO Max than any other market in this report, with a 9.0% demand share, surpassing the global share of demand for this platform’s content, which stands at 5.0%. Hulu initially held the largest share of demand for its originals in Brazil among the markets in this report.

However, its share contracted significantly at the end of the year, dwindling to 7.8% in December 2021. A competitive race for demand share unfolds throughout the year among Apple TV+, HBO Max, and Hulu in Brazil. Hulu led at the start of the year, HBO Max took over mid-year, and by the year’s end, Apple TV+ claimed the largest demand share among the three platforms.

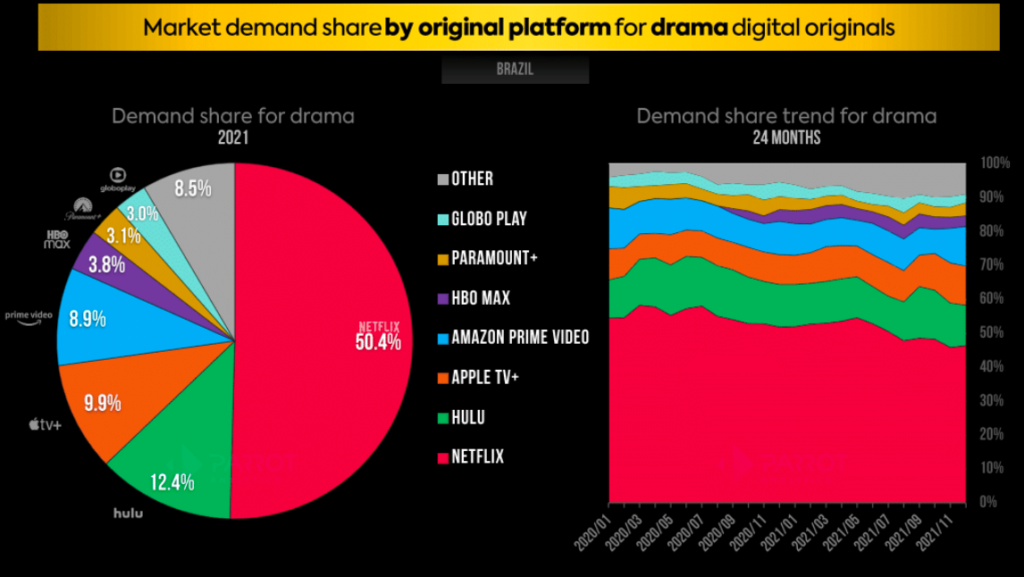

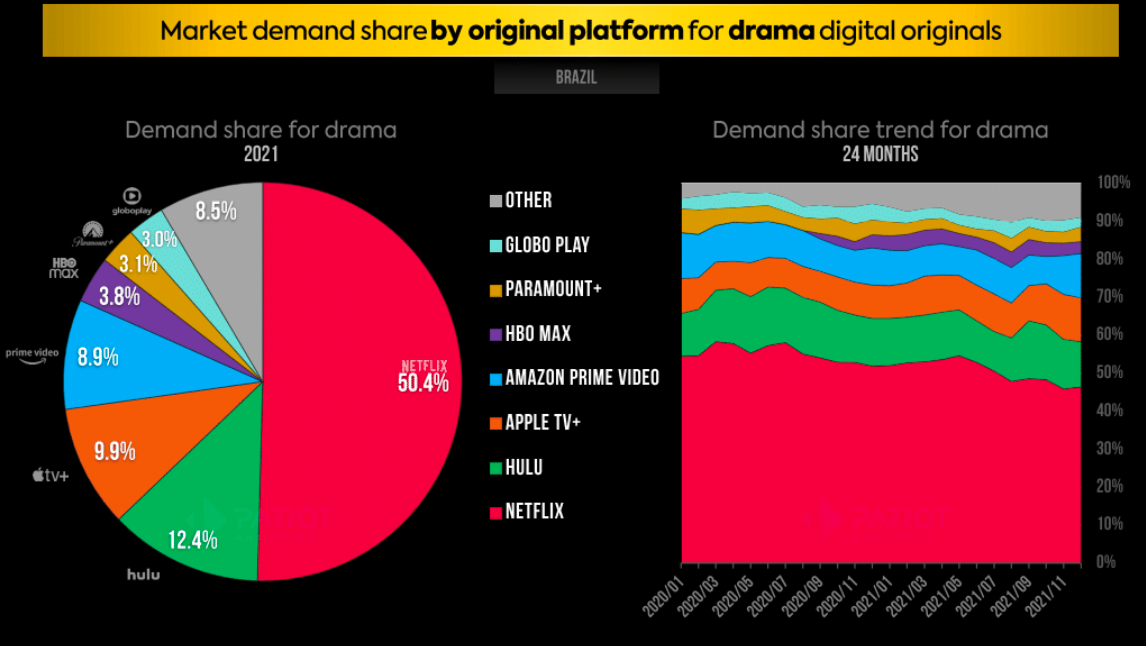

Brazil Drama and Action/Adventure Digital Originals Platform Demand Share: In Brazil, original series from Hulu contributed to 12.4% of demand in the drama genre this year. Brazil uniquely positions Hulu’s originals as having the second-largest share of demand for original dramas, following Netflix. Amazon Prime Video’s dramas faced noticeable under performance in Brazil this year, securing only an 8.9% demand share for digital original dramas.

This represents the platform’s smallest share across markets in this report and falls well below its global share of demand in the drama genre, which stands at 13.0%. Dramas from Apple TV+ accounted for 9.9% of demand for original dramas in Brazil.

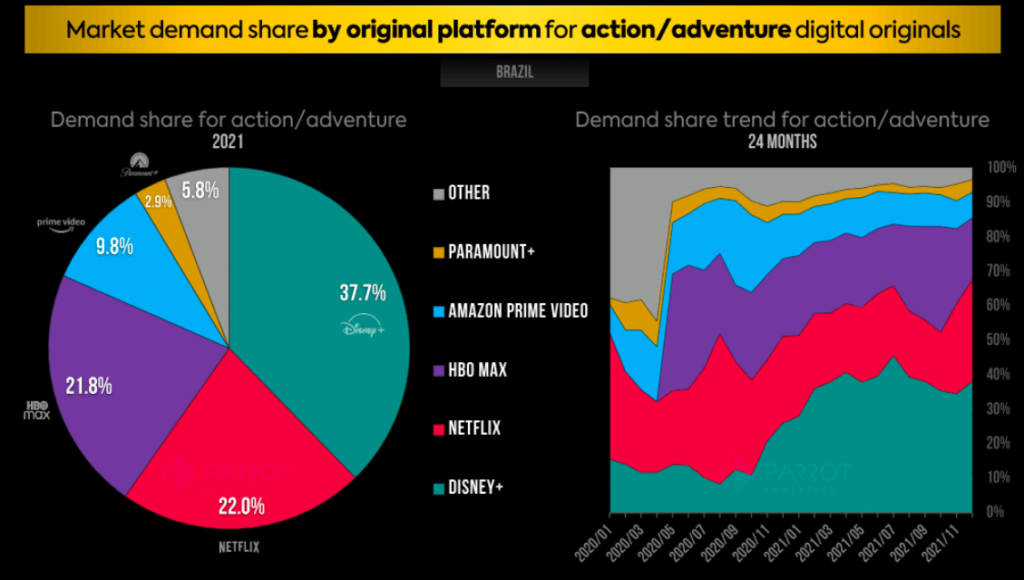

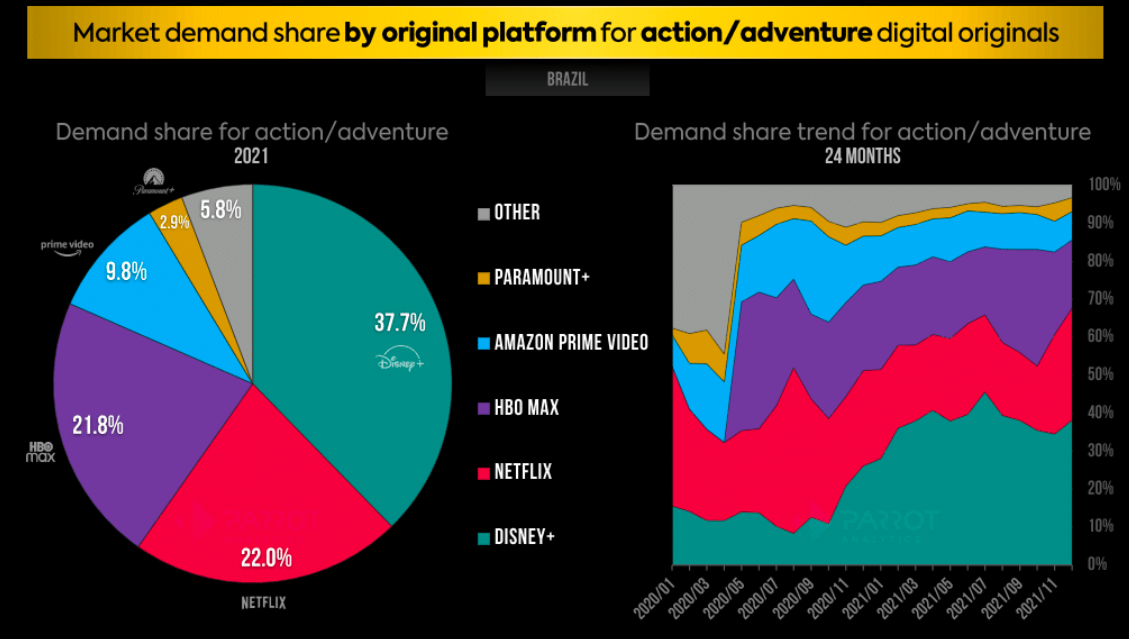

HBO Max experienced its peak success with Action/Adventure originals in the Brazilian market

contributing to 21.8% of the demand for such content this year. This achievement placed HBO Max in close competition with Netflix, which held a slightly higher share of 22% in the genre.

However, the landscape shifted noticeably for HBO Max in the Action/Adventure genre due to the rise of Disney+. This year, HBO Max finds itself in a notably weakened position. While in 2020, there were instances where HBO Max held the largest share of demand for Action/Adventure originals in Brazil, this dynamic has not repeated itself in the current year.

Amazon Prime Video, on the other hand, experienced a significant decline in demand share for its Action/Adventure originals. In 2020, the platform’s originals accounted for 16.3% of demand in this genre. However, in 2021, its share has contracted to 9.8%, marking a noteworthy decrease in its market presence.

HBO Max experienced its peak success with Action/Adventure originals in the Brazilian market, contributing to 21.8% of the demand for such content this year. This achievement placed HBO Max in close competition with Netflix, which held a slightly higher share of 22% in the genre.

However, the landscape shifted noticeably for HBO Max in the Action/Adventure genre due to the rise of Disney+. This year, HBO Max finds itself in a notably weakened position. While in 2020, there were instances where HBO Max held the largest share of demand for Action/Adventure originals in Brazil, this dynamic has not repeated itself in the current year. Instead, HBO Max is engaged in a competitive battle with Netflix for the second-place position.

Amazon Prime Video, on the other hand, experienced a significant decline in demand share for its Action/Adventure originals. In 2020, the platform’s originals accounted for 16.3% of demand in this genre. However, in 2021, its share has contracted to 9.8%, marking a noteworthy decrease in its market presence.

Please subscribe to DEMAND360LITE to access the latest version of The Global Television Demand Report and to discover the latest content analytics and trends for TV series on cable, broadcast, OTT and SVOD streaming platforms around the world.

Presented below is the section for Brazil from The Global Television Demand Report. Enjoy!

Brazil digital original genre and subgenre preferences

- Brazil is tied with Canada as the most horror-loving market in this report. Both markets gave a 3.1% share of demand to the horror genre in 2021.

- Brazil had the second largest share of demand for digital original action/adventure series in this report. The18.3% share of demand for the genre was exactly the same share of demand audiences gave to the genre in Brazil last year.

- Brazil had the second largest share of demand for original reality series, behind only the reality-loving American market in this report. Brazilians’ share of demand for the genre increased to 4.6% this year from 2.8% in 2020.

- Superhero series was the most in-demand digital original subgenre in Brazil for the year. It had a strong lead over the second ranked subgenre, sci-fi drama, which had 25% less demand than superhero series in 2021.

- Competition reality was uniquely successful subgenre in Brazil this year. It ranked as the 7th most in-demand subgenre for the year. Brazil was the only market in this report where a reality subgenre ranked in the ten most in-demand.

- The life story subgenre was the 8th most in-demand subgenre in Brazil in 2021. This is the highest rank for the subgenre in this report, which it also achieved in Mexico.

Brazil platform demand share and digital originals demand

- Brazilians gave a larger share of demand to originals from HBO Max than any other market in this report. The 9.0% of demand for HBO Max originals was well above the global share of demand for this platform’s content–5.0%.

- Hulu had the largest share of demand for its originals in Brazil of markets in this report but its share of demand has been significantly squeezed at the end of the year, shrinking to 7.8% in December 2021.

- It has been a tight race between Apple TV+, HBO Max, and Hulu for demand share in Brazil. At the start of the year Hulu had the largest share of demand; by mid-year HBO Max was in the lead; at the end of the year, Apple TV+ had the largest demand share of the three platforms

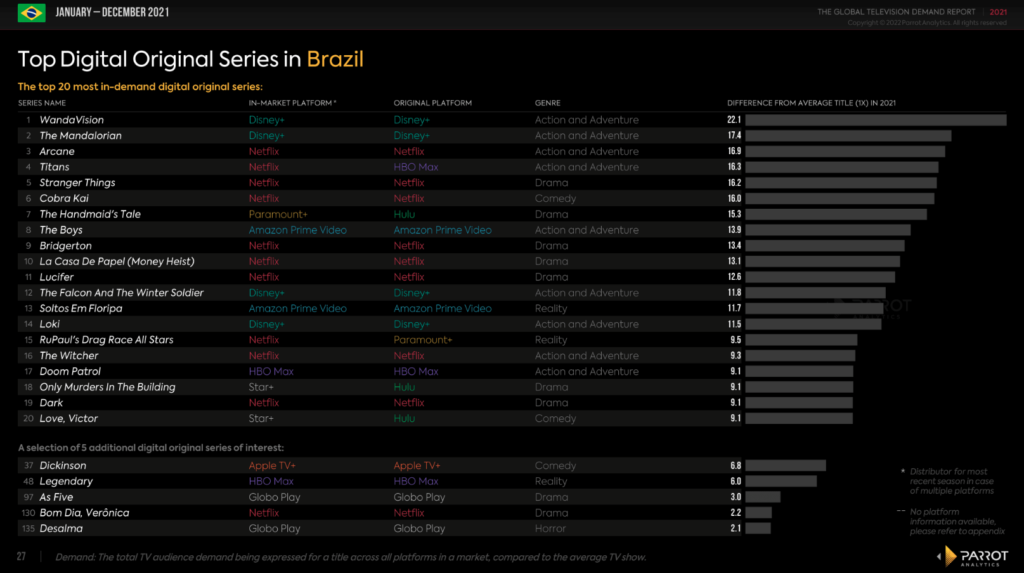

- Brazil was one of two markets in this report (along with Mexico) where WandaVision was the most in-demand digital original of 2021. It had 22.05 times the average series demand in Brazil this year.

- High demand for reality series like Soltos em Floripa, RuPaul’s Drag Race All Stars, and Legendary helped make Brazil one of the most reality-loving markets in this report. These three series ranked higher in Brazil than in any other market in this report (13th, 15th and 48th respectively).

- Bridgerton found an especially strong base of fans in Brazil. With 13.45 times the average series demand, the show had higher demand in Brazil than in any other market globally this year.

Platform demand share for drama and action/adventure digital originals

- In Brazil, original series from Hulu accounted for 12.4% of demand in the drama genre this year. Brazil was the only market in this report where Hulu’s originals had the second largest share of demand for original dramas behind Netflix.

- Amazon Prime Video’s dramas noticeably underperformed in Brazil this year. The 8.9% of demand for digital original dramas that was for an Amazon original was the platform’s smallest share across markets in this report and well below its global share of demand in the drama genre, 13.0%.

- Dramas from Apple TV+ accounted for 9.9% of demand for original dramas in Brazil. This was the only market where the share of demand for Apple TV+ surpassed Amazon Prime Video in this genre.

- Action/adventure originals from HBO Max found their greatest success in the Brazilian market where they accounted for 21.8% of demand for action/adventure originals this year, nearly overtaking Netflix, which had a 22% share in the genre.

- However, following the success of Disney+ in the action/adventure genre, HBO Max is in a considerably weaker position this year. At several points in 2020, HBO Max had the largest share of demand for action/adventure originals in Brazil. That has not happened this year, where it has been battling Netflix for second place.

- Amazon Prime Video has lost significant demand share for its action/adventure originals. In 2020 its originals made up 16.3% of demand in this genre. In 2021 its share has shrunk to 9.8%.

Top digital original series in Brazil

Here are the top 20 most in-demand streaming original series in 2021 across all platforms: