Netflix has implemented new strategies to increase its subscriber numbers and revenue as more consumers are cancelling their SVOD (subscription video on demand) subscriptions.

One of these strategies is the introduction of cheaper plans in various regions, aimed at attracting more customers. The streaming giant has reduced its subscription prices in multiple countries.

In its latest Q1 results, Netflix reported that it experienced growth in subscriber numbers. North America saw an increase of 100,000 subscribers, while Europe witnessed a growth of 640,000 subscribers.

Additionally, 1.5 million new subscribers were added in the combined regions of MENA (Middle East and North Africa) and APAC (Asia-Pacific). However, there was a decline of 450,000 subscribers in Latin America.

Netflix grow up

During an earnings call, Spencer Adam Neumann, Netflix’s chief financial officer, explained that the adjustments in subscription prices reflect the company’s efforts to achieve better market fit, product market fit, and pricing fit.

The aim is to increase market penetration and improve medium- and long-term revenue, benefiting both Netflix members and the business.

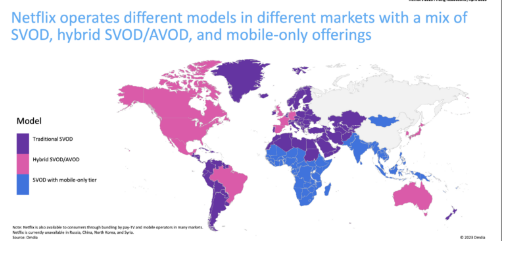

A recent report by Omdia, a research organization affiliated with DTVE (Digital TV Europe), sheds light on Netflix’s strategic decision to significantly reduce prices for subscription plans in smaller markets.

This is particularly evident in regions where billing is done in non-local currencies or where local currencies have experienced significant depreciation against the US dollar over the past year.

For instance, in Kenya, Netflix has made substantial price cuts. The Basic plan’s price was reduced by KES400 (US$2.93), while the Standard plan saw a decrease from KES1,100 to KES700, and the Premium plan dropped from KES1,450 to KES1,100.

Local Content

Netflix has yet to fully localize its service in smaller markets by implementing billing in local currencies. This is due to the fact that Netflix has been considered a niche service in many of these smaller markets, and its uncompetitive pricing has limited its reach to wealthier audiences.

According to Omdia, the lack of localization has likely hindered Netflix’s growth in these markets, resulting in low subscription numbers in developing regions.

Netflix’s service in smaller markets is currently billed in US dollars, resulting in effectively higher prices over time due to the strength of the USD.

As a response to this, Netflix has implemented the largest pricing cuts in African markets, with slightly smaller reductions in European and Middle Eastern markets. Specifically, the introduction of mobile-only plans in markets with limited fixed-line broadband penetration, such as various African and Asian markets, has resulted in price drops ranging from 25% to 33%.

Billed in Dollars

For African markets billed in USD, the monthly price now stands at $2.99. In Asian markets like Mongolia or Laos, the mobile-only tier is priced at $3.99 per month. In Iraq, a standard subscription costs $3.99, while in neighboring Kuwait, it is priced at $8.20. Furthermore, the subscription fee in Jamaica is $3.99, which is less than half of the $8.99 fee charged in the Bahamas.

Netflix’s recent pricing cuts have brought its subscription prices closer to those of its global competitors in the region. According to Omdia, South America is the only region where Netflix remains the most expensive service on average. However, it should be noted that Disney+ and Amazon have not yet expanded their services to all territories worldwide.

Omdia highlights examples such as Serbia, Bulgaria, and Romania, where Netflix subscriptions are billed in euros instead of the local currency. In these markets, Netflix offers substantially lower prices compared to Amazon Prime and Disney+. This adjustment in pricing aims to enhance Netflix’s competitiveness and attract more subscribers in these regions.

Netflix Espanding

While Netflix focuses on expanding in developing markets, Omdia emphasizes the importance of investing in local content, in addition to pricing, to drive growth. The report highlights a lack of region-specific content in North Africa, sub-Saharan Africa, and Southeastern Asia, in contrast to the abundance of culturally relevant content in Europe and Eastern Asia.

Omdia points out that content from other Arab countries would resonate well in North Africa, and South American content would gain popularity in Central America. However, there still exists a content gap that needs to be addressed.

Netflix has announced plans to invest $1.9 billion in local content in the Asia-Pacific region in 2023, with a focus on India, Indonesia, the Philippines, and Thailand. This investment is expected to yield significant gains in these markets.

Ted Sarandos, Netflix’s co-CEO and director, stated during an earnings call, “Every one of our big content wins starts as a local win. By creating stories that drive growth in local territories, we provide content that resonates with audiences, and it’s equally likely that we can have a massive hit from anywhere in the world. That’s the scale of our operation.”