The streaming device provider and FAST operator reported a 1% year-over-year increase in total net revenue, reaching $741 million, with a decline in advertising.

Total net revenue was up by 1% year over year, with streaming hours up by 4.2 billion hours. While active accounts were 71.6 million, a net increase of 1.6 million from Q4 2022, with streaming hours climbing up to 25.1 billion.

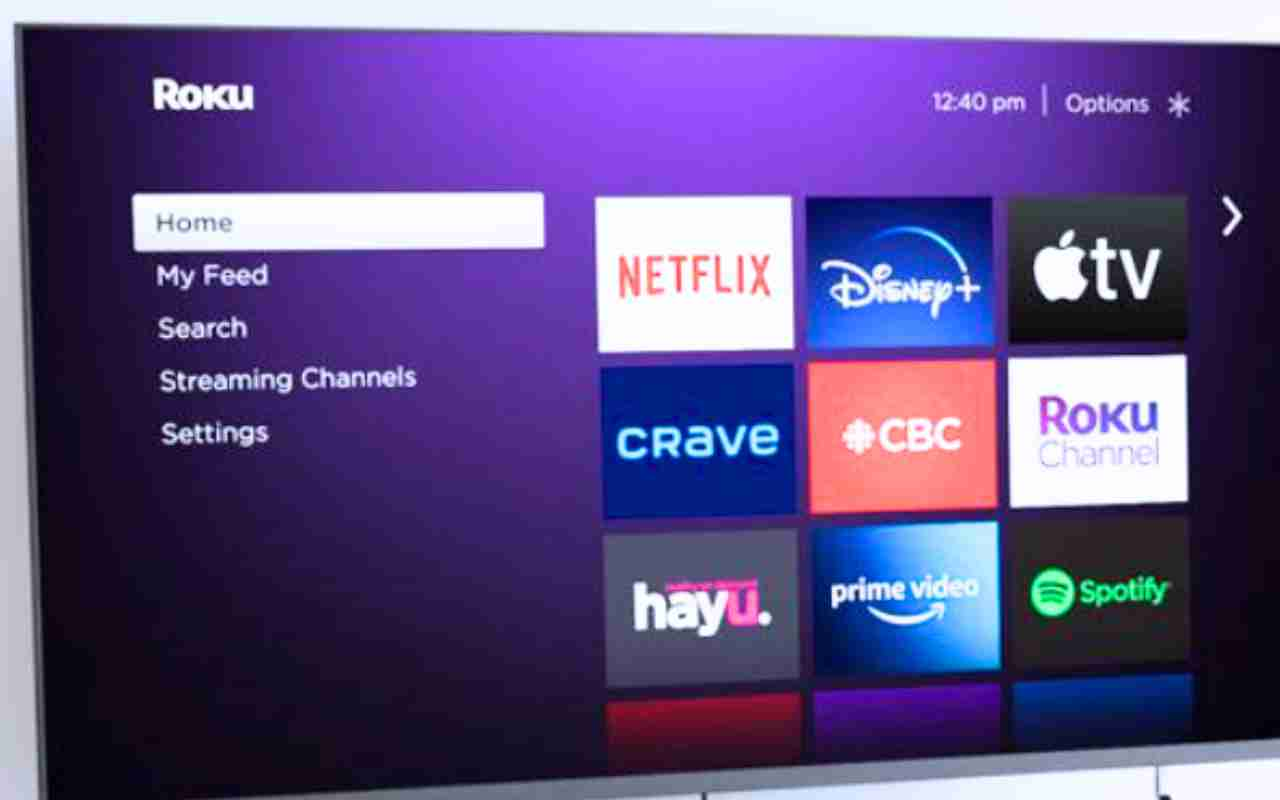

The company has reported that the Roku operating system was the #1 selling smart TV OS in Mexico and in the US where it had 43% TV unit share.

However, platform revenue was down 1% year hitting $635 million, and average revenue per user had fallen by 5%. Roku explained “the macro environment remained challenged in Q1” with the total US advertising market down 7.4%.

Alongside this, the platform revenue was down 1% year hitting $635 million, and average revenue per user had fallen by 5%.

Ad spend decline on traditional TV had dropped by 12.7%, and traditional TV ad scatter was down 20%. Alongside this, Roku’s platform revenue was down 1% year hitting $635 million, average revenue per user had fallen by 5%, and faced a 7% decline plummeting to $338 million.

The company said this is driven by pressure placed on consumers “by inflation and recessionary fears, and thus discretionary spend is likely to remain muted.”

Roku plan platform with adverting sales

Roku plans to generate platform revenue through advertising sales, the distribution of streaming services, the distribution of FAST channels, Roku Pay, and its media & entertainment (M&E) promotional capabilities.

In a statement Roku said, “As noted last quarter, we are developing more and deeper relationships with third-party platforms, including retail media networks, demand-side platforms, and other partners. We have begun to access new parts of advertiser budgets with several large clients that have specific DSP needs by making certain ad inventory more accessible. We are seeing positive early results with Q1 programmatic sales representing its highest share of revenue of all time. Our first-party and ACR data, along with our specialized ad products, will continue to remain accessible only on the Roku advertising platform, allowing us to manage both demand and distinction.”