FAST channels are altering the use of connected TVs by offering a free and accessible alternative to traditional streaming services.

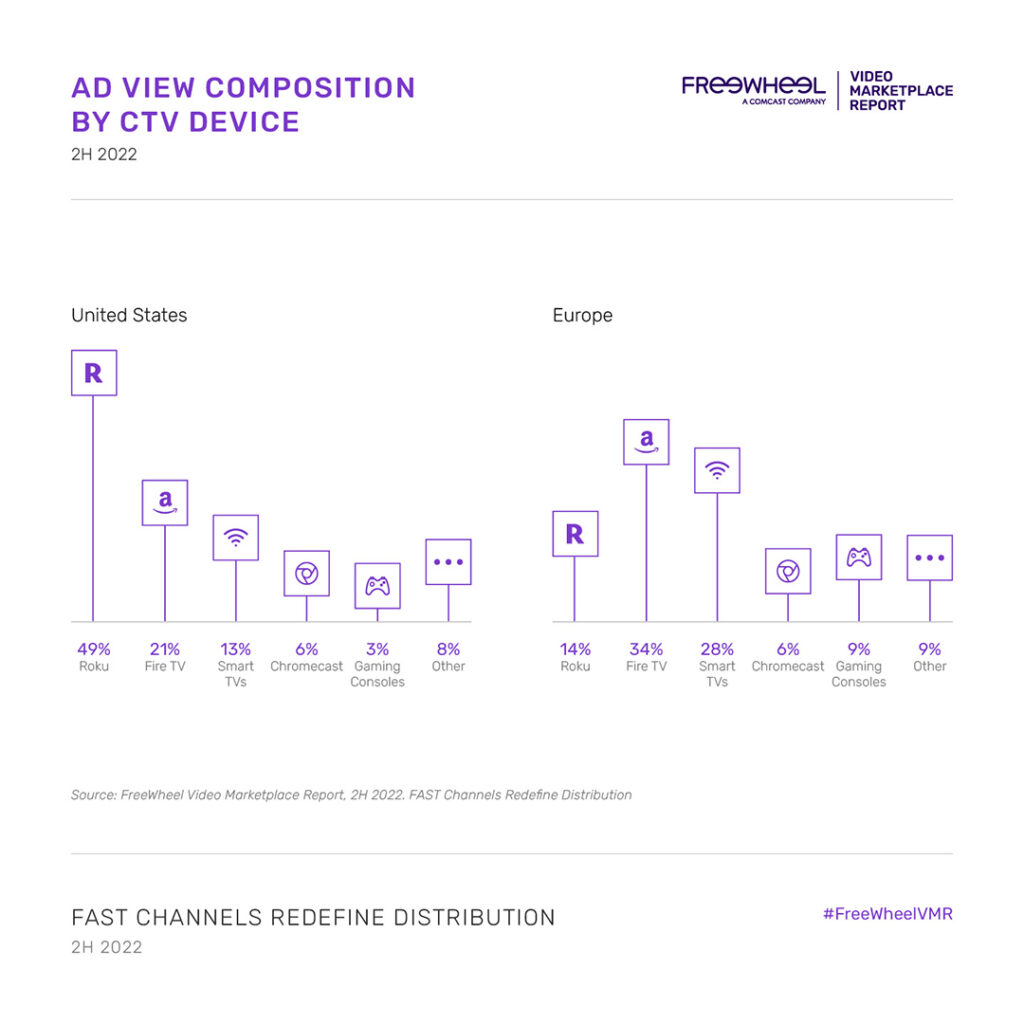

These are ad-supported streaming services that offer live and on-demand content, such as movies, TV shows, and news, through streaming platforms like Roku, Amazon Fire TV, Apple TV, and other connected devices. Users of these services can access content without having to pay a monthly subscription, but in exchange, they have to watch ads during content playback.

This business model has proven to be popular among users looking to save money on subscription costs for traditional streaming services.

In Europe, ad views have increased by at least 13% more than in the US. Access to premium content in Europe is mainly through a platform that requires login. The FreeWheel study involved 11 European countries (Belgium, Estonia, Finland, France, Germany, Italy, Latvia, Lithuania, the Netherlands, Spain, and the UK) and the US, and the report is based on the last six months of 2022.

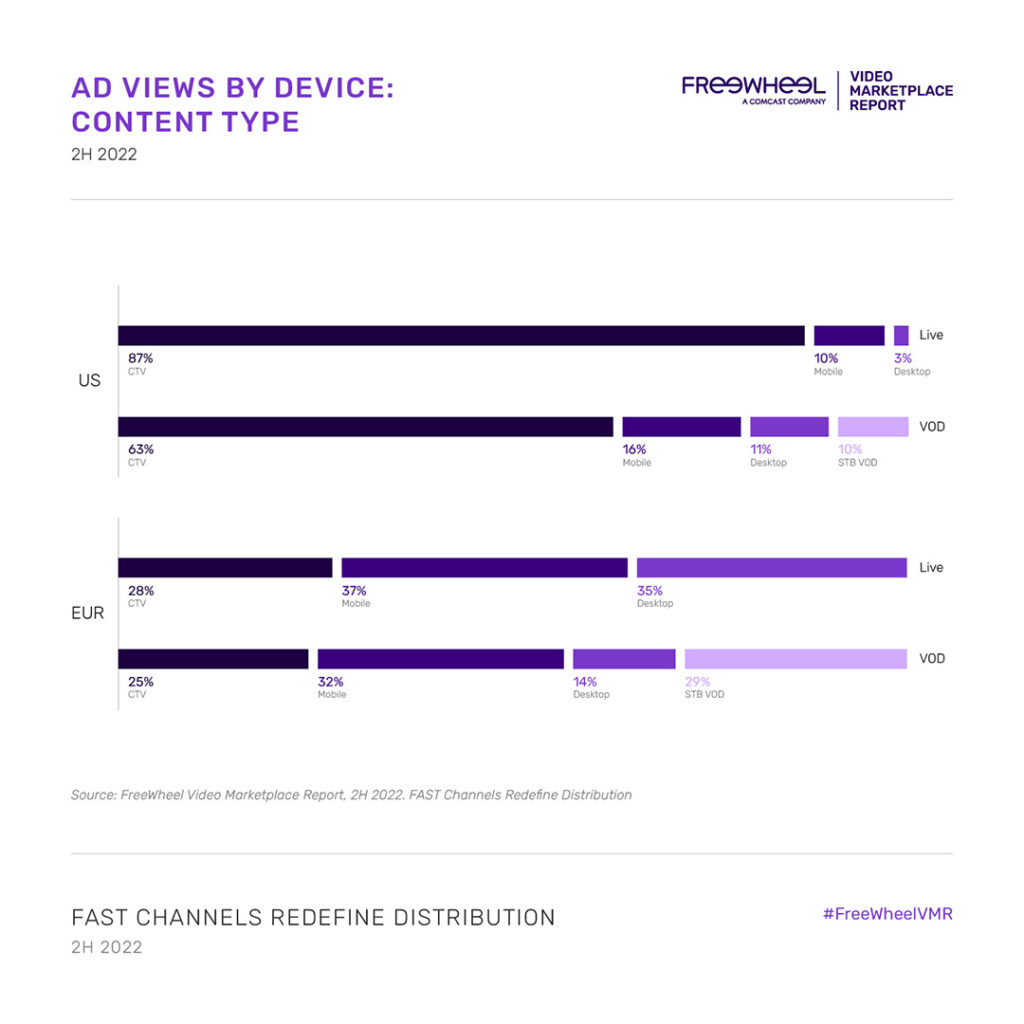

According to the Video Marketplace Report, the evolution of these platforms favors ad consumption. In Europe, ad views in the second half of 2022 saw a year-on-year growth of 13%. The TV screen remains essential, with 56% of views occurring through connected or on-demand TV.

Unlike in the US, where access to content occurs 62% through OTT devices (outside the paywall), 80% of content accessible on these platforms asks users for authentication. Connected TVs are crucial for advertising because they offer advertisers the opportunity to reach an engaged audience in viewing experiences in a premium environment with contextual messages.

Fast Channel in Europe

Although Europe is slowly making progress, strict data protection regulations limit targeting, so 72% of campaigns are based on demographic targeting, unlike the US, where advertising is based on behavioral targeting, defining more precise and concrete data.

Advertising in the US In the US

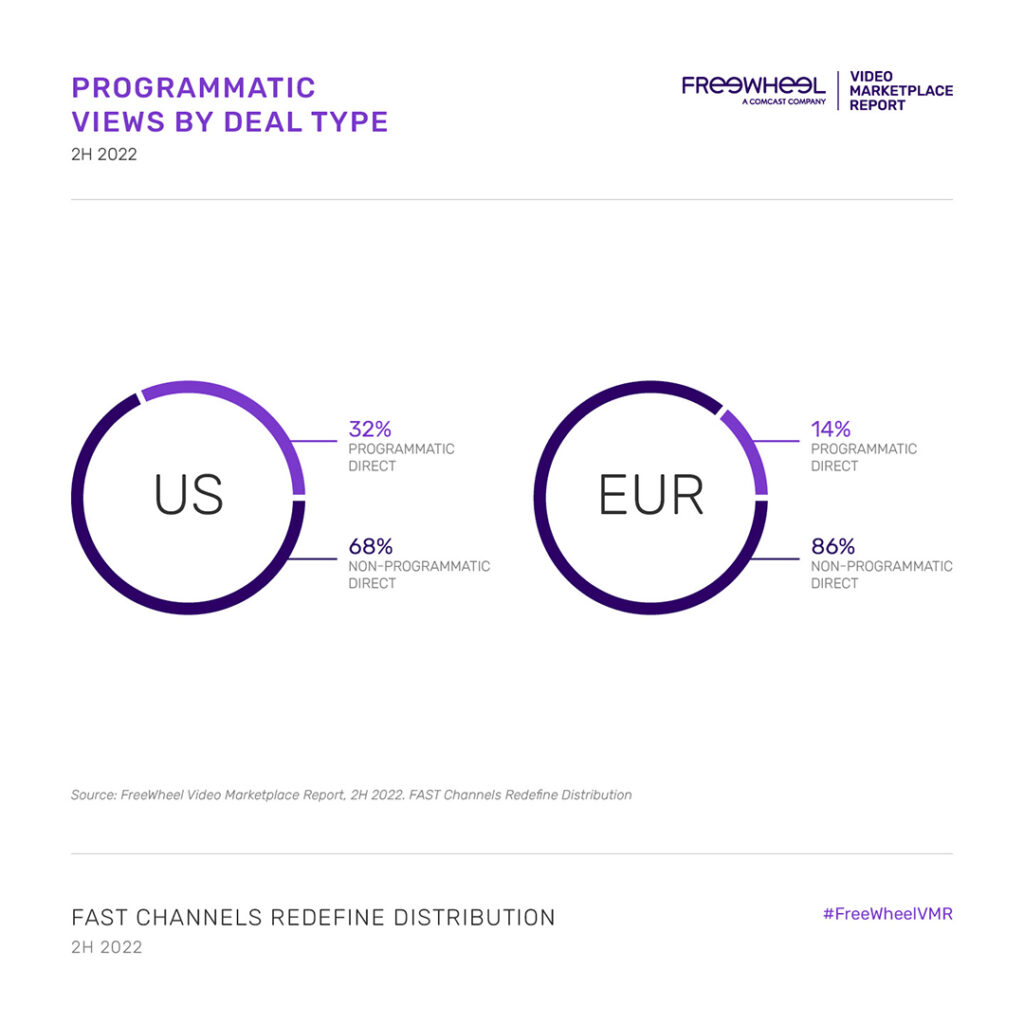

There is a clear increase in “programmatic” campaigns, which now represent 32% of all transactions, supported by the widespread adoption of CTV and the exceptional growth of FAST channels. In Europe, this type of advertising represents 14% of total transactions, most of which occur in Programmatic Guaranteed. Such transactions could continue to grow as agreements become more precise, and privacy laws become less stringent.